How to Offset Your W2 Income with Rental Property Losses

- On March 5, 2025

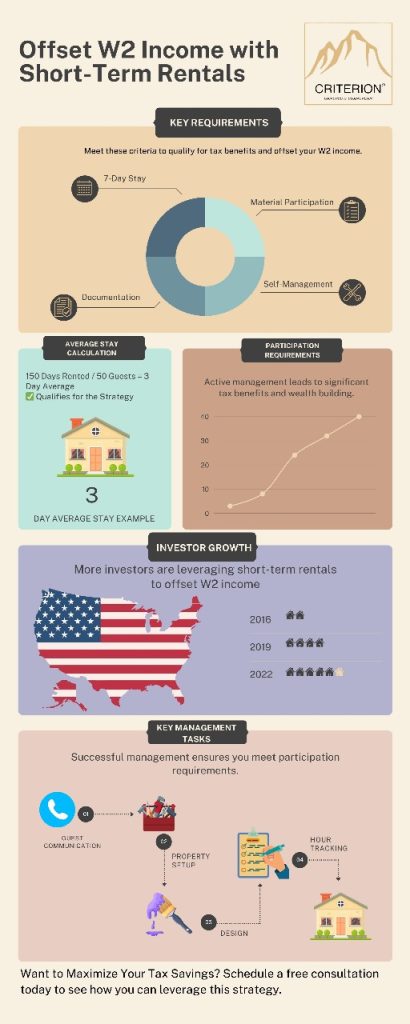

Real estate investors have long recognized the power of property investment as a wealth-building tool. However, many are unaware of a lucrative tax planning strategy that allows them to offset W2 income with rental property losses. This strategy, often overlooked by accounting and bookkeeping services in the USA, involves short-term rentals. By meeting specific IRS requirements, property owners can classify their rental property as a non-passive activity, thereby unlocking valuable tax deductions.

In this article, we’ll explore the key requirements, how to calculate your average stay, and the material participation test. You’ll also learn how smart real estate investors are leveraging short-term rentals to reduce their taxable income while growing their real estate portfolios and improving cash flow.

Understanding the Requirements

To take advantage of this tax planning strategy, your residential property or commercial property must meet four essential criteria:

- The average stay of guests must be 7 days or less

- You must meet the material participation test

- You must self-manage the property

- You must document all activities and hours spent managing the property

If you meet these requirements, you can use rental property losses to offset your W-2 income, thereby reducing your overall tax burden

Calculating Your Average Stay

The IRS considers rental properties where guests stay for an average of 7 days or less as short-term rentals, which allows them to be classified as active income rather than passive income. Here’s an example to illustrate how you can calculate your average stay:

- Total days rented: 150

- Total number of guests: 50

- Calculation: 150 days ÷ 50 guests = 3-day average stay

Since the average stay is under 7 days, this property qualifies for the short-term rental tax strategy.

Meeting the Material Participation Test

To ensure your rental losses can offset your W2 income, you must materially participate in the rental business. The IRS defines material participation using several criteria, but for most short-term rental investors, the following three tests are the most relevant:

- You spend more than 500 hours managing the rental per year

- You are the only one materially participating, and you spend at least 100 hours managing the rental

- You spend more time managing the property than any other person (including property managers, cleaners, or handymen)

By meeting at least one of these tests, you can classify your rental activity as non-passive, enabling you to offset your W-2 income with rental losses

Self-Managing the Property

Unlike long-term rentals, where property managers handle day-to-day operations, involved in managing your short-term rental to qualify for this tax benefit. Here’s what you need to do:

- Handle guest communication: Respond to inquiries, coordinate check-ins and check-outs, and address any guest concerns.

- Manage the property setup: Purchase furniture, install smart locks, and ensure the unit is guest-ready.

- Staging and design: Create an appealing space that attracts guests and enhances their experience.

- Track your hours: Document every task you perform related to the rental property. Use spreadsheets or property management software to keep accurate records.

Although you can hire cleaners and handymen to assist with maintenance, you must remain the primary manager of the property.

Document Everything

The IRS requires documentation to prove your level of involvement in the rental activity. Without proper records, you risk losing the ability to offset your W2 income with rental losses in the event of an audit.. Here are some tips for keeping accurate records:

- Track all communication with guests via email, Airbnb, or direct booking platforms.

- Record your time spent on tasks such as guest interactions, marketing, and maintenance.

- Save all receipts and invoices for expenses related to furnishing and maintaining the property.

- Use a time-tracking tool to log your hours managing the rental.

By maintaining detailed records, you can defend your tax position if audited by the IRS.

Unlock Your Business’s Full Potential with Expert Tax Strategies!

The Tax Benefits of Short-Term Rentals

Once you meet the IRS requirements, your short-term rental losses can directly reduce your taxable income. Here’s how it works:

- Depreciation Deduction: You can deduct depreciation on the rental property, lowering your taxable income. A cost segregation study can help identify building components eligible for accelerated depreciation.

- Operating Expenses: Costs related to repairs, utilities, cleaning, and supplies are deductible.

- Interest Deduction: If you have a mortgage, the interest paid is tax-deductible.

- Bonus Depreciation: Certain assets, such as appliances and furniture, may qualify for accelerated depreciation.

By leveraging these tax deductions, investors can significantly reduce their tax liability while building long-term wealth. A cost segregation study can help categorize property components into 5-year, 7-year, and 15-year depreciation schedules, maximizing tax deductions

Common Pitfalls to Avoid

While this strategy is powerful, there are common mistakes that could disqualify you from claiming rental losses against W2 income:

- Failing to meet the material participation test: If you don’t actively manage the rental, you won’t qualify.

- Not keeping proper documentation: Without records, you could lose your deductions in an audit.

- Hiring a full-time property manager: If someone else is handling operations, you won’t meet the self-management requirement.

- Allowing average stays longer than 7 days: Longer average stays classify the property as a passive rental.

Avoiding these mistakes will help ensure you maximize your tax benefits and stay compliant with IRS regulations.

Final Thoughts

Smart real estate investors are using short-term rentals to offset their W2 income while building wealth. By understanding and implementing the IRS requirements, you can legally reduce your tax liablity and create a profitable real estate investment strategy.

If you’re considering short-term rentals, start by calculating your average stay, tracking your participation hours, and documenting your involvement. With the right approach, you can turn your rental property into a tax-saving investment vehicle while generating passive income.

Key Takeaways:

- Your average stay must be 7 days or less.

- You must materially participate in managing the rental.

- Proper documentation is essential to qualify.

- This strategy allows rental losses to offset W2 income.

- A cost segregation study can help maximize depreciation deductions.

By following these guidelines, you can optimize your real estate investments and maximize tax savings. Whether you’re dealing with residential property or commercial property, understanding the tax categories and depreciation rules for qualified property, including leasehold improvements and interior components, can significantly impact your investment’s profitability. Remember to consider the purchase price, property acquisition costs, and potential for cash flow when evaluating investment opportunities. Happy investing! Be sure to consult with a tax professional to ensure compliance and maximize your deductions