Extreme Tax Savings: Strategies of the Ultra-Wealthy and Lessons for Businesses

- On January 28, 2025

When it comes to cutting down on taxes, rich people can use some of the cleverest and tricky tax savings strategies to lower or even wipe out what they owe. These methods show how people can work their way through the tax rules to keep their money safe. They do this by taking advantage of gaps in the financial system and using tax rules that not many people know about. Let’s take a closer look at some of the most extreme ways people have saved on taxes, saving them millions. We’ll also share some tips on how companies and individuals can make the most of their money using things like bookkeeping services, cost segregation services, and other financial strategies.

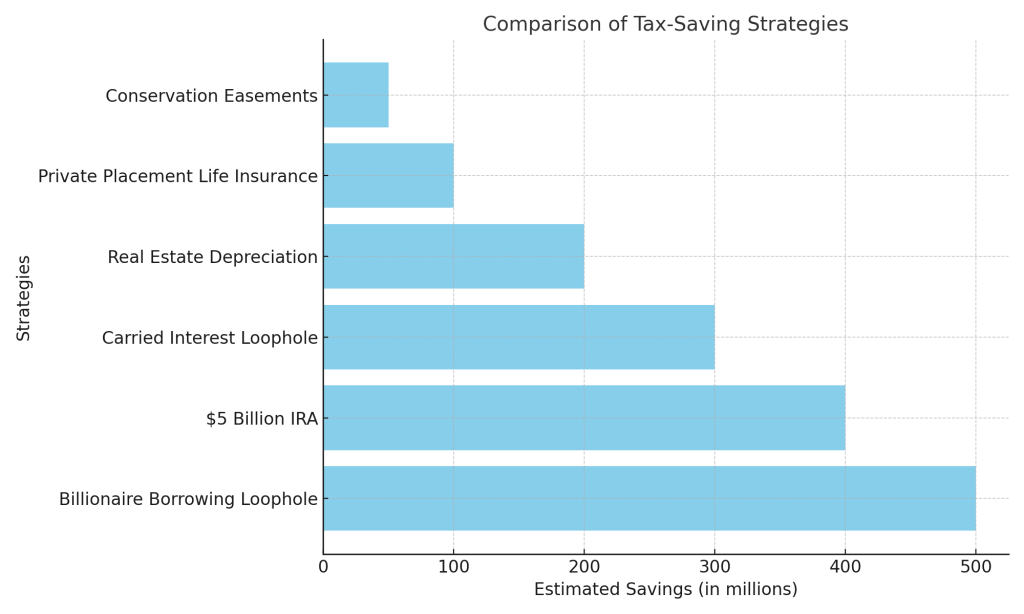

1.The Billionaire Tax Saving Borrowing Loophole

This approach has become a key way for billionaires with big stock portfolios and other valuable assets to keep their wealth. When they borrow money using their assets as security, rich people can get lots of cash without paying capital gains taxes. They use stocks and other money-related assets as collateral for these loans, which lets them pay for their lifestyles while staying away from tax bills.

Big names like Larry Ellison and Elon Musk have used this trick a lot. Musk, for instance, has taken out billions in loans against his Tesla stock, which helps him avoid the capital gains taxes he’d have to pay if he sold the shares outright. This plan shows why it’s so important to work with tax accountants in Houston or other big cities to understand how to manage assets and deal with tax responsibilities. Small businesses can also benefit from similar strategies by working with a local CPA for small business or seeking online CPA services for startups to optimize their financial planning.

2. The $5 Billion IRA

Tech tycoon Peter Thiel’s transformation of a Roth IRA into a $5 billion fortune stands out as an exceptional example of tax-free growth. Thiel put low-value PayPal shares in the account in 1999, using the Roth IRA’s tax-free growth feature to build up billions in untaxed gains. The IRS looked at such moves, suspecting they might break rules. This case shows how smart tax planning can lead to huge savings.

Business owners and professionals need to use tax-advantaged accounts and strategies. Working with CFO services and the best company to get tax relief can help find ways to save money long-term while following tax laws. For small businesses, utilizing virtual bookkeeping services or outsourced accounting services can provide similar benefits on a smaller scale.

3. The Carried Interest Loophole

Hedge fund managers, private equity partners, and venture capitalists benefit significantly from the carried interest loophole. This strategy allows their compensation to be taxed at the lower long-term capital gains rate rather than the higher ordinary income tax rate. The result? Substantial savings on millions of dollars earned annually. Despite frequent debates over closing this loophole, it remains a critical tax-saving tool for those in high finance.

Business owners looking to optimize their financial strategies can learn from these practices. Utilizing Houston bookkeepers and tax resolution services ensures accurate financial management while minimizing tax burdens through legitimate methods. Even small businesses can benefit from professional bookkeeper services to maintain accurate financial statements and optimize their tax strategy.

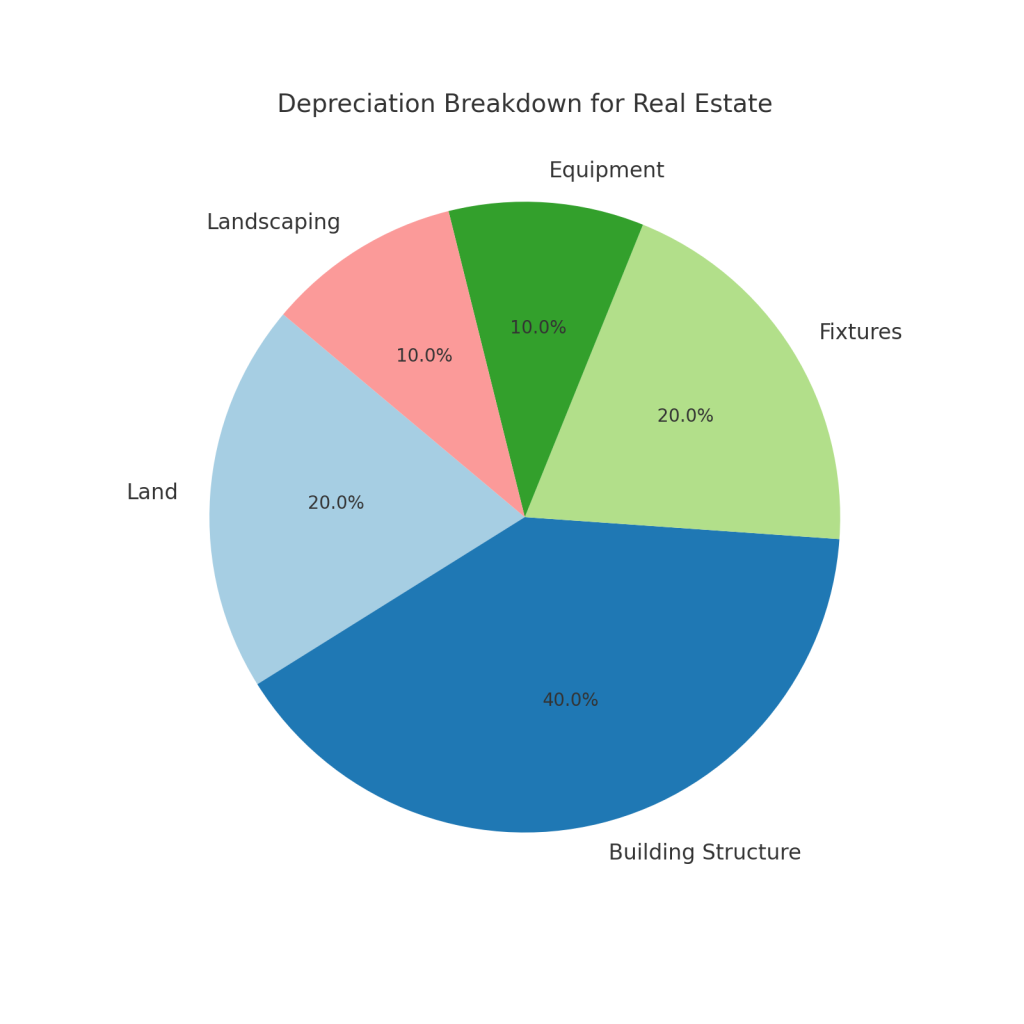

4. Real Estate and Oil Industry Tax Havens

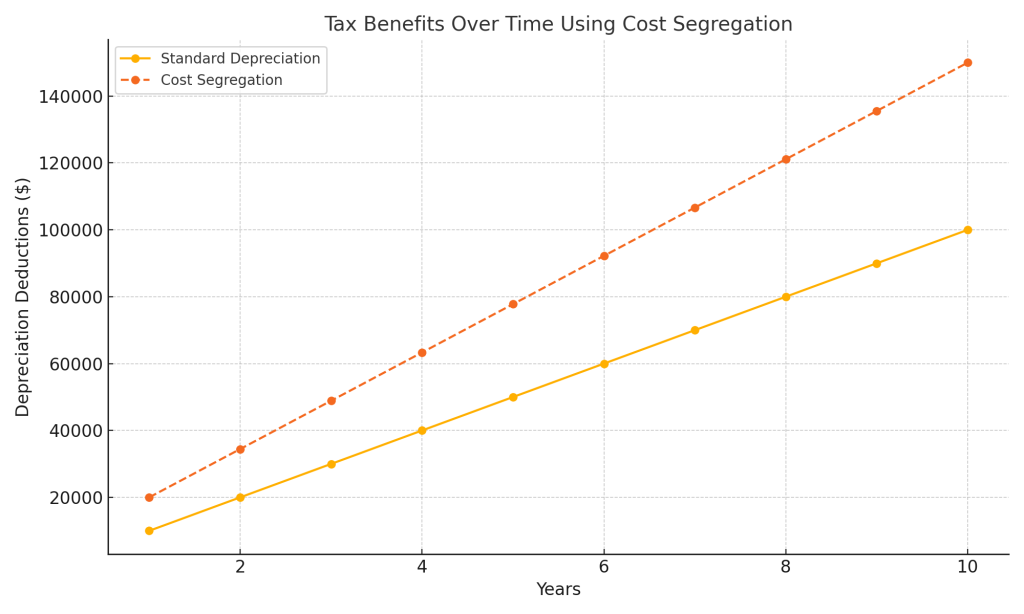

Real estate and oil industry moguls have long leveraged depreciation and income deferral to erase their tax liabilities. For instance, real estate developer Stephen Ross went a decade without paying income tax by taking advantage of depreciation write-offs. Similarly, oil tycoons have used extensive deductions tied to environmental cleanup costs to offset taxable income.

Tools like a cost segregation study for real estate play a crucial role here, allowing property owners to reclassify building components for faster depreciation. By accelerating deductions, this strategy significantly improves cash flow. Businesses involved in commercial real estate construction loans can particularly benefit from such tax advantages, making it essential to work with experienced CPAs in Houston to navigate these opportunities. Cost segregation services can be especially valuable for those with investment properties, providing substantial tax benefits through accelerated depreciation.

5. Private Placement Life Insurance

Reserved for the ultra-wealthy, private placement life insurance (PPLI) allows policyholders to invest premiums in high-growth options like hedge funds. The cash value of these policies grows tax-free, and holders can borrow against the policy at low interest rates. Upon the policyholder’s death, the benefits pass tax-free to beneficiaries. This strategy combines investment growth with significant tax savings, making it an attractive option for preserving wealth across generations.

For smaller businesses or individuals, the principle of tax-efficient investing still applies. Utilizing the best online bookkeeping services for small business ensures that all income and deductions are tracked accurately, creating opportunities to optimize financial strategies. Financial advisors can help develop tailored investment strategies that maximize returns while minimizing tax liabilities.

Unlock Your Business’s Full Potential with Expert Tax Strategies!

6. Syndicated Conservation Easements

This controversial strategy involved groups of investors purchasing land, inflating its value through appraisals, and then donating it for conservation purposes to claim outsized tax deductions. Though the IRS has cracked down on these practices, many of these deductions have held up under audit. This tactic highlights the creativity that some taxpayers employ to minimize their liabilities.

While this strategy operates on the edge of legality, legitimate approaches like cost segregation services and compliance-focused tax planning provide safer and more sustainable methods for businesses and investors to save on taxes. Working with the best company for tax relief ensures adherence to legal standards while maximizing deductions. Small businesses should focus on maintaining accurate financial reports and leveraging accounting software to ensure tax compliance and identify legitimate deductions.

How Businesses and Individuals Can Optimize Taxes

Houston has some of the best and most competent tax preparers in the United States. Whether you are a small business owner searching for CFO services for small businesses, or an individual searching for help making use of a variety of tax credits, enlisting the services of the right professional can make all the difference.

A pro in tax planning helps you to avoid costly mistakes by ensuring that your taxes are taken care of correctly.

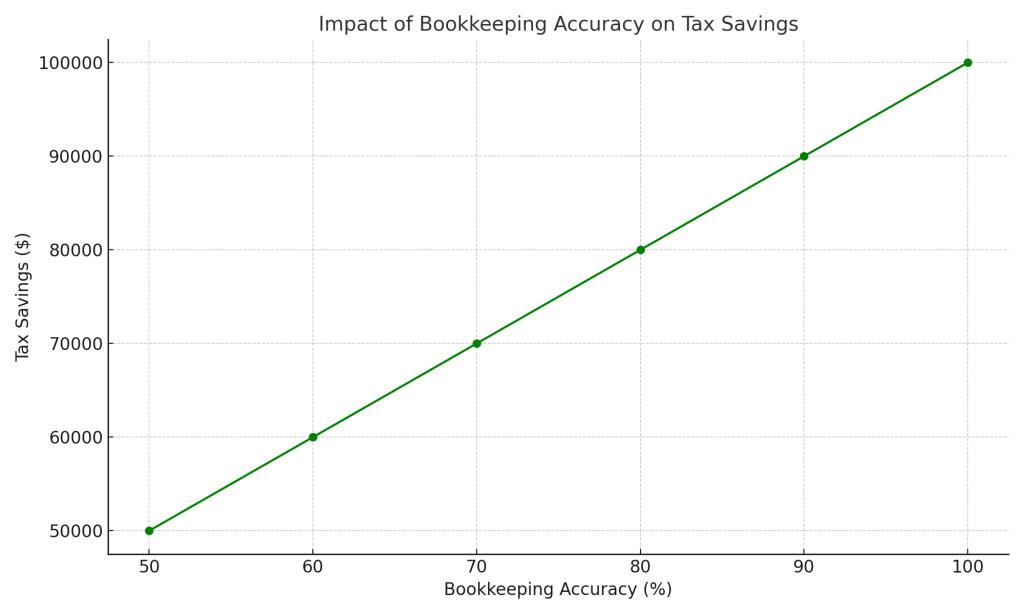

1. Leverage Bookkeeping Services

Accurate and efficient bookkeeping is the foundation of effective tax planning. Services like Houston bookkeeper or virtual accounting services help ensure all income, expenses, and deductions are properly documented, reducing the risk of errors and penalties. For small businesses, accounting and bookkeeping services can provide crucial support in managing financial data and preparing for tax season.

2. Utilize Cost Segregation Services

For property owners, a cost segregation study for real estate is a powerful tool to accelerate depreciation and boost cash flow. This strategy is particularly useful for those involved in commercial real estate construction loans, as it frees up capital for reinvestment. Cost segregation can provide significant tax benefits by identifying and reclassifying personal property assets to enable shorter depreciation recovery periods.

3. Work with Expert CPAs and CFO Services

Engaging with professional tax accountants in Houston or CFO services provides the expertise needed to navigate complex tax codes and identify opportunities for savings. These professionals can also assist with financial forecasting and budgeting. For startups and small businesses, online CPA firms can offer affordable access to expert financial advice and tax preparation services.

4. Partner with the Best Company for Tax Relief

If you face tax liabilities or disputes, working with the best company for tax relief or reliable tax resolution services can help resolve issues efficiently and minimize the impact on your finances. These services can be particularly valuable for businesses dealing with complex tax situations or facing IRS audits.

4. Partner with the Best Company for Tax Relief

If you face tax liabilities or disputes, working with the best company for tax relief or reliable tax resolution services can help resolve issues efficiently and minimize the impact on your finances. These services can be particularly valuable for businesses dealing with complex tax situations or facing IRS audits.

5. Plan for the Future

From private retirement accounts to estate planning, taking a long-term view of your finances can create significant tax-saving opportunities. Partnering with advisors who understand your industry and goals is critical to success. This includes staying up-to-date with accounting software and QuickBooks integration to streamline financial management and decision-making processes.